Starling Bank Sort Code

The digital Starling Bank is based in the UK and offers its clients cutting-edge and practical banking services. Starling Bank gives each of its clients’ accounts a unique sort code like any conventional bank. An account’s specific bank and branch can be determined using the sort code, a six-digit number.

For several banking operations, such as starting direct debits, receiving payments, and sending money to other accounts on the Starling bank app, you must get your Sort code. Ensuring that cash is accurately transferred between accounts and banks is essential.

Read on for a better understanding of Starling bank Sort code.

What Does the UK Sort Code Mean?

The bank codes used to route money transactions between banks within each nation through their separate clearance organizations are called sort codes by the British and Irish banking industries. The six-digit sort code number also serves as an identification number for the bank and branch where the bank account is kept.

The bank is identified by the first digit of the sort code in certain situations and by the first two digits in other cases. Current sort codes for Starling Bank Limited are 1.

How a Sort Code Looks Like

Firstly, you need to have it at the back of your mind that six digits make up a sort code. It appears as follows: 00-01-02. The last four digits commonly refer to the branch where you started the account, while the first two digits typically identify the bank your account is with (for instance, HSBC or Barclays).

The sort codes are basically used to direct financial transfers to the right bank and account.

Your sort code is typically printed on the back of physical cards, the bottom of checks, your statements from banks, or your online accounts. Where your bank includes this data will vary. Since sort codes represent a bank and branch rather than a customer, they are likewise in the public domain.

Online-only banks without physical locations may only give their clients one sort code. For instance, the sort code for each Starling Bank account is 60-83-71, while the sort code for each Monzo account is 04-00-04.

Sort codes, solely used in the UK and Ireland, are crucial in assisting all financial institutions in verifying the legitimacy of a transfer and properly routing money. IBANs are, therefore, frequently utilized.

Starling Bank Sort Code

Your Starling bank sort code is a crucial element of your account. Your bank’s sort code is a six-digit number. The last four numbers belong to the same branch of the bank where you created the report, and the first two digits are typically divided into pairs to indicate which bank it is.

Because sort codes only identify banks and branches, not specific accounts, and because they don’t divulge personal information, they are freely available online.

Sort codes are crucial to the British banking system, so it’s best to memorize yours so you may send and receive payments at all times without difficulty. Remember that you must enter it each time you start a new direct debit payment or when you anticipate receiving money in your account. Your sort code is printed immediately on the checkbook, so you won’t need to provide it when paying with a check.

Since Starling has no branches, all of their clients use the same sort code, which is 60-83-71

Why Get the Starling Bank Sort Code?

Getting a Starling Bank sort code is helpful and here are some situations where the Starling Bank Sort Code may be required:

- Creating Direct Debits or Standing Orders: You will generally need to supply the Sort Code and your account number to approve regular payments from your Starling Bank account, such as for utility bills or subscriptions.

- Receiving Payments: Your account number and the Sort Code are required when someone wishes to send money to your Starling Bank account. To effectively start the transfer, they must have this information.

- Mobile Payments: During the setup procedure, the Sort Code may be required if you plan to utilize mobile payment apps or services that let you send or receive money to and from your Starling Bank account.

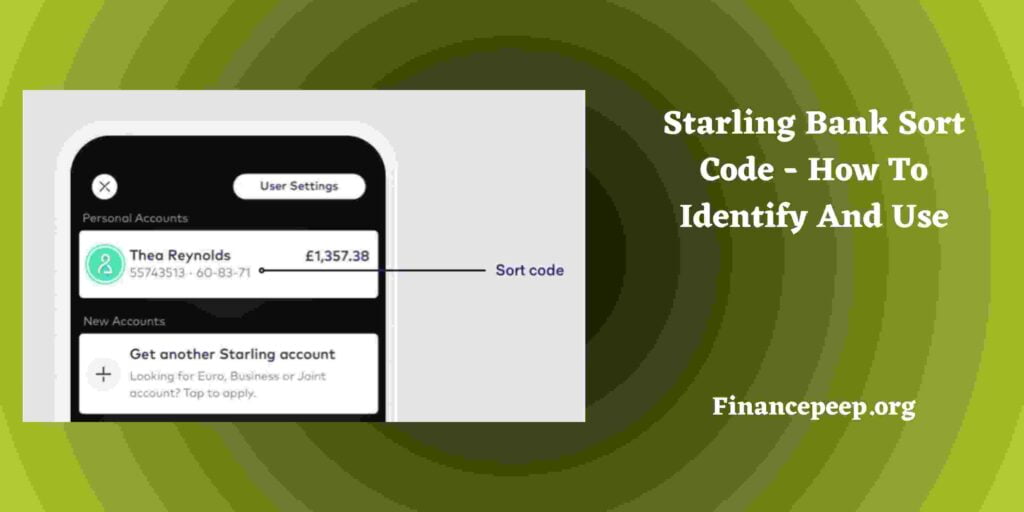

How To Get Starling Bank Sort code

Follow the steps highlighted below to get your Starling bank sort code:

- Open your Starling Bank app.

- Enter your username, password, or any other authentication you’ve set up to access your account.

- The account overview screen will appear once you have successfully logged in.

- If you have numerous accounts, choose the one where you wish to find the sort code.

- Your account number, sort code, and other critical account-related facts should all be visible on the account details tab.

- The sort code that appears on the screen should be noted. It usually has two sets of three numbers and six digits, such as 12-34-56.

If the steps above are not successful, then you can:

- Visit Starling Bank’s main website.

- Go to the website’s “Contact Us” or “Support” section.

- Look for a way to reach their customer care team, such as a phone number, email address, or live chat option.

- Call Starling Bank’s customer service and tell them you need your account’s Sort Code.

- They will walk you through the required verification procedure to verify your identification and account information.

- The customer service agent can give you the Sort Code for your Starling Bank account once your identity has been verified.

- In addition, the Sort Code is frequently shown on your account statements, online banking accounts, and mobile banking apps.

How To Locate a Sort Code With An IBAN

An IBAN can be used to find information, such as the sort code, regarding the account involved in an overseas transaction.

The sort code will be the 9th, 10th, 11th, 12th, 13th, and 14th numbers in IBANs for the UK or Ireland. So, the sort code for GB92BARC00010212345678 is 000102.

Remembering the structure will allow you to determine the sort code for each IBAN. It always goes like this:

- Continent code

- Check the digits

- BBANs (Basic Bank Account Numbers)

Also you should know that within the BBAN, the sort code will always appear after the bank code in letters. You’ll notice variations in other countries’ BBANs because sort codes are only utilized in the UK and Ireland.

Frequently Asked Questions

What distinguishes an IBAN from a kind code?

A six-digit number called a sort code identifies an account’s bank and branch. In the UK and Ireland, sort codes are employed, commonly formatted as XX-XX-XX. On the other hand, an international bank account number (IBAN) is a standardized format for identifying bank accounts. IBANs, up to 34 characters extended and typically used outside of the UK and Ireland, start with a country code and are followed by a two-digit checksum.

IBANs are used to identify banks and accounts during international payments, while sort codes are used to identify banks during domestic transfers.

Are Sort Codes Used by The UK And Ireland Only?

Yes. In the 1950s, six-digit sort codes were established in the UK and Ireland as part of efforts to automate the banking sector. They are not employed anywhere else in the globe. Other nations use standardized techniques to rapidly and effectively route money to the correct location.

When Will My Sort Code Be Needed?

Sort codes are a safe way to recognize banks. You will need your sort code to set up a standing order or direct debit. You will require their sort code whenever you wish to send money to someone else.

Can I have more than one sort code with Starling Bank?

Typically, each customer receives a single sort code from Starling Bank. However, each account may have a different sort code if you have multiple Starling Bank accounts.

Can I Send Money Internationally Using My Starling Bank Sort Code?

Yes, you can send money internationally using your Starling Bank sort code. For foreign transactions, however, extra information could be needed besides the sort code, such as the bank’s BIC or SWIFT code.

Can I modify my sort code for Starling Bank?

Your Starling Bank sort code cannot be changed. The bank assigns the sort code, which is connected to your account. It is advised to contact Starling Bank’s customer service if you need to make any modifications or updates to your account.

Conclusion

In conclusion, the sort code is an essential part of British banking, including for users of Starling Bank. A unique six-digit number identifies the bank and branch linked to an account. The sort code is used in various banking operations, including accepting payments, starting direct debits, and sending money.

Customers of Starling Bank can often find the sort code on official bank documents or in the mobile app. To ensure smooth and precise money transfers, it’s critical to have access to your sort code.

Contact the bank’s customer service for individualized advice and help if you have any queries or require assistance with your Starling Bank sort code.

We hope the information provided was really helpful!

Be the first to comment